Key findings: Millennials most open to managing personal finances online but more likely to want the human touch, too

- Over half of 25-34 year olds (53%) are comfortable using an online service to manage their personal finances

- 54% of 25-34 year olds like the idea of a service that takes into account their wider financial information

- Despite this, they are more likely to expect a person to be part of this service (85%, vs 22% average across other age groups)

Younger consumers are more comfortable allowing a web-based service to intelligently review and manage their personal finances according to research from Altus. Over half (53%) of 25-34 year olds are comfortable with this, compared to 51% of 35-44 year olds, 47% of 45-54 year olds and only 38% of over 55s.

Altus surveyed 1,000 UK working adults across the country as part of their consumer research to give a snapshot of attitudes towards online personal finance, digital (‘robo’) advice, and the potential impact of Open Banking which came into force back in January.

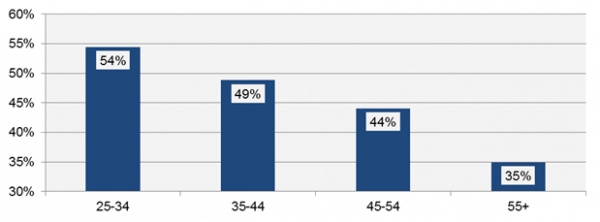

The results also showed that younger users are more open to sharing wider financial information with online services; over half (54%) of 25-34 year olds comfortable with using an online service are happy to share information on all of, or a combination of their savings, investments, pensions, other assets, and their debts. This level of openness is far higher than with older generations and decreases with age (see chart 1) despite the older age groups potentially having far more to gain from a service that can analyse their financial situation and make proactive recommendations

Millennials favour convenience over security

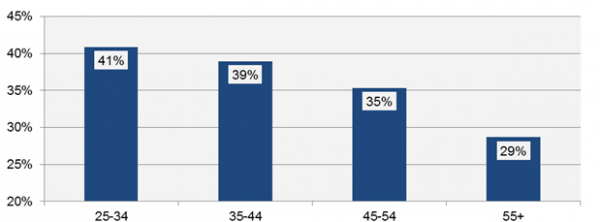

As well as sharing the data, younger users are also much more open to the concept of an online service that enables them to view their entire financial situation in one place (balance, savings, pensions, loans, mortgages etc.) across all providers (41% of 25-34 years olds – see chart 2 for a comparison with other age groups); they recognise the benefits – particularly convenience – of this, and this bodes well for the many organisations using the Open Banking freedoms to develop new and exciting propositions to help consumers better manage their money.

Going one step further, 68% would be interested in an online service that stored personal, financial and medical information in one place, prioritising the value exchange of convenience and benefits over any potential security threat.

Younger customers still require a human touch

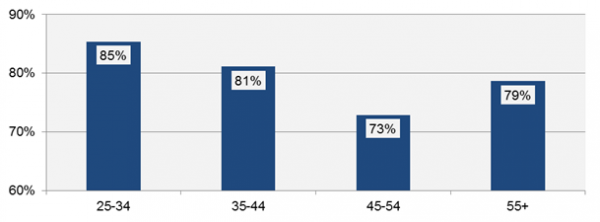

Despite this confidence in online personal finance, millennials are more likely to expect a human interaction as part of this service. Of millennials who were comfortable with using a digital (‘robo’) savings and investment service, 85% want the service to provide access to a person via webchat or phone during and/or after they had made the decision to invest. This is higher than all other age groups (see chart 3).

Of those who were not comfortable using an online service, over a quarter (26%) would have changed their mind if they knew the service also provided a human engagement – compared to just 12% average across other age groups, and only 7% of over 55s.

On the findings, Simon Bussy, Domain Director of Wealth at Altus Consulting commented: “It’s interesting to see that, whilst the younger generation is open to managing their personal finances online, they are more likely to expect, and want, a human interaction as part of this offering. We still live in a world where many people still like the reassurance of speaking to a human during the decision-making process, and I don’t expect that to change any time soon.

“Organisations need to focus on developing a hybrid service – augmenting the undoubted benefits of technology with the empathy and understanding that people bring. We’re already seeing forward-thinking organisations working hard to combine human interaction with best-in-class technology solutions at different points in the process, meeting consumer demands and lowering costs, making them more accessible to all.

For those looking to develop solutions or broader propositions underpinned by the Open Banking regulations, these are important findings that demonstrate the opportunities available to those businesses that have a business model that enables them to focus on the longer term benefits of the younger generation, not just those with significant assets already.”

Charts:

Chart 1 – Percentage of respondents who were comfortable using an online service, and would be happy sharing all/ a combination of their savings, investments, pensions, other assets and debts with the service.

Chart 2 – Percentage of respondents who like the idea of an online service which is able to bring together the up-to-date balances or valuations of all of their savings and investments, pensions, bank details, any credit or store card spending and any personal loans or mortgages

Chart 3 – Percentage of respondents comfortable with using an online service who would have needed the service to provide access to a person via webchat or to enable them to speak to a person during, and/or after they had made the decision to invest.

Credit: Altus Consulting